VA Financing

VA financing gives you the ability to use your entitlement to buy a home with no money down or get cash out up to 100% of your homes value.

VA financing for Veterans.

As part of the GI bill in 1944 for returning veterans from WWII the VA has guaranteed over 20 millions home loans since its inception. The program is simple, you can use your VA entitlement to purchase a home with no money down. Or you can refinance your mortgage get cash out up to 100% of the value of your home.

Do I qualify for VA financing?

You must obtains a certificate of eligibility to qualify for VA financing. This is earned through 24 months of active duty service through the Army, Navy, Marines, Air Force, and Space Force. This applies to anyone serving from 1980 to present. Prior to 1980 shorter active duty status during a theatre of combat may qualify you. For the national guard or coast guard typically 6 years of service will make you eligible for a VA home loan if you were honorably discharged. You must obtain your certificate of eligibility. When ordering this you must provide a copy of your DD -214. This is something you can do yourself here or we can order it for you.

What fees are associated with VA financing?

The VA charges a guarantee fee. For first time users of the program the fee is 2.15%, this gets financed into the loan. So you if you are buying with no money down, your loan amount would be 102.15% of the purchase price. If you are a subsequent user of the program the fee is 3.3%. The VA has a 1% cap on origination fees from the lender as well. You will still have title fees, taxes, survey, appraisal fees, inspection fees and other various items that can add up. The VA allows you to ask for up to 4% of the sales price to go towards the buyer’s closing costs. That 4% cap does not apply to setting up your escrow account for homeowners insurance and property taxes, so its actually possible to ask for more.

What is the minimum credit score for VA financing?

With VA financing we go to a 500 credit score, both for purchases and cash out refinances. This is with an automated underwriting approval. Its possible with a score in the 500’s we may need to do a manual underwrite. In that case you can’t have any late payments on your rent or a prior mortgage within the last 12 months.

How much can I be approved for?

Typical VA financing allows for loans up to $647,200 but jumbo VA financing is also available. If you are purchasing a home with multiple units the max loan amount is higher. When it comes to calculating the max debt allowed the VA is different than any other program. The max debt ratio is calculated by residual income. That means after all your expenses including childcare you need to have a certain amount of money left over determined by the VA. This figure changes depending on the amount of dependents you have. Its not uncommon though for the automated underwriting system to approve deals with back end debt ratios (total monthly debt obligation including your housing expense) up to 70% of your income.

VA financing in summary.

VA financing makes it easier than any other program out there to make your home ownership dreams come true. Even secondary financing is available for veterans to use the program twice with two active loans. We finance veterans for million dollar loans all the time, the program is that good. If you happen to be a disabled Veteran your funding fee is waived. This program is designed to help those who have put it all on the line for our country and we are proud to serve our Veterans the best way we can with their home financing needs.

Get Pre-approved

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

Black Rock Mortgage

a division of Coast 2 Coast Mortgage

Company NMLS: 376205

CA 60DBO-139024

93 ½ King Street

St. Augustine, FL 32084

Contact

Toll Free: (855) 482-6466

Local: (352) 619-4959

keith@blackrockmortgage.com

Fax: (888)-979-6574

Quick Links

Fax: (888)-979-6574

News & Updates

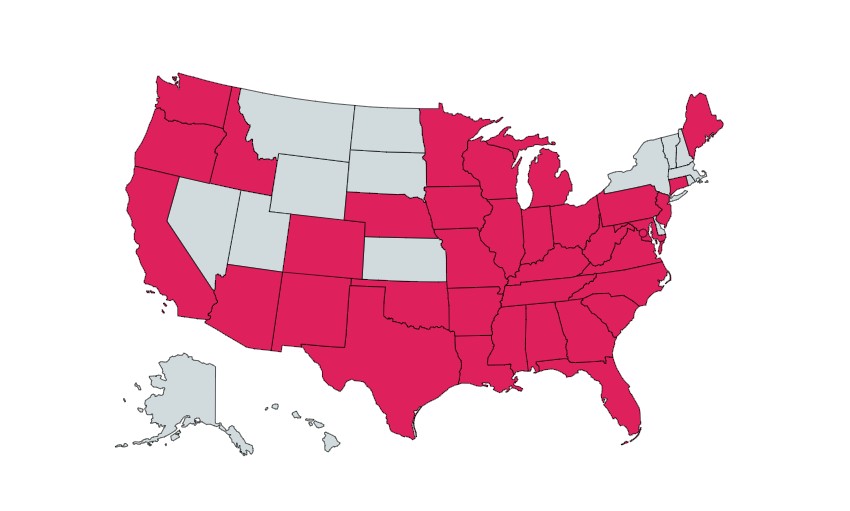

This website and the content within is not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. We are licensed in Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Colombia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virgin Islands, Virginia, Washington, West Virginia, Wisconsin.