USDA Home Loan

A USDA home loan gives you the ability to buy with no money down, the program is available in rural communites.

USDA Home Loans.

The United States Department of Agriculture has a rural development program that allows individuals to buy a single family home, townhome, or manufactured home with no money down. Contrary to what the initial onlooker may think this program is not for buying working farms. Homes can be purchased on minimal acreage. In fact working farms are prohibited. Acreage is fine, pastures are fine. Raising animals for hobby are fine, but this program is meant help people purchase primary residences in rural areas.

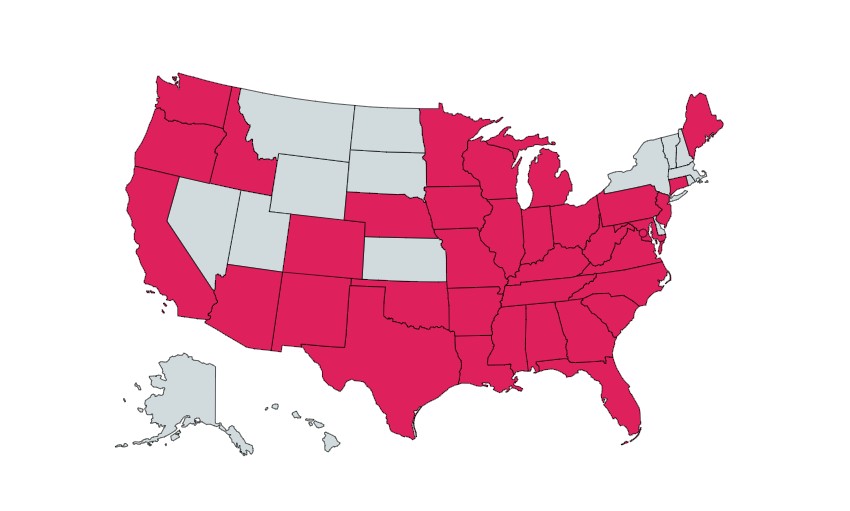

Where can I use a USDA Home Loan?

You must purchase a home in an eligible area for USDA. The department of agriculture bases eligibility off of population density. The eligibility map changes every year. Its best practice to check eligibility on the USDA property eligibility website. This is a rural development program, but rural is based off of population density, not acreage or even a rural feel.

Income Limits For USDA Mortgages.

The USDA imposes household income limits for the program. This is unique to USDA financing and its very important to consider. Even if a member of your household is not going to be on the mortgage, if they earn or receive income it has to be documented. For a household of 4 or less the average income limit is around $112,450. This changes state by state and county by county so once again, its best to check the income limits directly on the USDA income eligibility page. Additionally for a household of 5 or more the income limit goes to about $148,450 on average. Deductions can be used for child care and dependents.

What is the minimum credit score for a USDA Home Loan?

With USDA financing we go to a 580 credit score, both for purchases and refinances. A manual underwrite with USDA financing is going to be needed for any deal with a 680 score or less in most cases. With a manual underwrite the max your total housing payment be of your monthly income is 31%. The max your total debt can be is 41%. With an automated underwriting approval, called a GUS approval with USDA financing. You can go up to a 46% back end debt ratio. If you don’t have a credit score, its still possible to qualify documenting alternative tradelines and doing a manual underwrite. An alternative tradeline can be rent, car insurance, a phone bill, cable, something that might now show on your credit report.

What are the costs for USDA financing?

The USDA charges a 1% guarantee fee. So whatever your loan amount winds up being its increased by 1% as this fee gets financed into the loan. Of course there is mortgage insurance as well, like FHA or conventional financing when you don’t have 20% down. For USDA financing this is .35% of the loan amount. So on a $300,000 loan its $87.50 a month. As your principal reduces so does the mortgage insurance. You will need an appraisal like other programs. Additionally you will need a bacteria water test if the home you are buying has a well. A termite inspection may be required as well.

One awesome feature with USDA financing, is that if the home appraises for more than the sales price, you can finance closing costs up to the difference! So lets say you bought it for $300,000, the appraisal comes in at $305,000. That $5,000 of closing costs you can finance. Don’t bank on that but its a great feature. Otherwise you can ask for up to 6% of the sales price from the seller to help with closing costs.

How much can I be approved for?

There is no maximum loan amount for USDA financing. Because of income limits though, you can only get a mortgage so large, even if you have no debt at at all. The maximum loan amount would be affected by homeowners insurance, property taxes, and any HOA costs. Additionally where you are buying would matter because of different income limits and household sizes.

USDA Home Loans in Summary.

USDA home loans are an absolutely great way to purchase a home. The program provides lower closing costs than other government programs with the power of buying with no money down. You don’t even have to a first time home buyer but of course its great for them too. If you have to live in a rural area or want to buy a primary residence in a rural area, USDA financing is a serious program to consider if you qualify. Get pre-approved below to see if you qualify!

Get Pre-approved

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

Black Rock Mortgage

a division of Coast 2 Coast Mortgage

Company NMLS: 376205

CA 60DBO-139024

93 ½ King Street

St. Augustine, FL 32084

Contact

Toll Free: (855) 482-6466

Local: (352) 619-4959

keith@blackrockmortgage.com

Fax: (888)-979-6574

Quick Links

Fax: (888)-979-6574

News & Updates

This website and the content within is not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. We are licensed in Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Colombia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virgin Islands, Virginia, Washington, West Virginia, Wisconsin.