FHA Mortgage Financing

FHA mortgage financing gives you the flexibility to make your home buying dreams come true..

FHA mortgage financing defined.

The Federal Housing Administration was started on June 27, 1934 to help stabilize the housing market with a program that included mortgage insurance and made it possible for more borrowers to be eligible for mortgage financing. FHA mortgage financing is still accomplishing that mission today with more flexibility in terms of credit score and debt to income ratios. Making it possible for borrowers to buy a home they couldn’t otherwise.

What are the FHA requirements?

FHA requires a minimum of 3.5% down with a score of 580 or higher. A credit score below 580 would require 10% down. You must have a 2 year work history, gaps are okay as long as you can go back prior to the 2 years to make up for any additional history needed to cover the gap. If you were in school and completed courses in association with your current job that can also suffice for documenting a 2 year work history. You must be at least 3 years from a bankruptcy, foreclosure, or short sale with some exceptions applying. If you are self employed FHA always requires 2 years of tax returns to qualify.

What condition must the property be in to qualify for FHA mortgage financing?

This is a topic of concern that often gets raised in regard to FHA financing. The property does not have to be in perfect condition, but there can not be any safety hazards or obvious malfunctions and or issues in disrepair. For example a hole in the drywall of the property would need to be fixed. If there is an outlet cover missing that can pose a safety risk, it would need to be remedied. An FHA appraiser would determine if there are any issues that need to be corrected before closing. In some cases if the repairs are too costly for the seller or buyer to correct before closing and escrow holdback would be allowed. This can be seller funded allowing for money to be held at title for the repairs to be completed after closing and then dispersed to the contractor upon completion.

How much can I borrow with FHA financing?

The current standard loan limit for 2025 is $524,225, but for high cost areas the FHA loan limit can go up to $1,209,750. It can also go up for multi family units. With an automated underwriting approval FHA mortgage financing allows for a total debt ratio of 56%. That means if you are a w-2 wage earner your total monthly debt including your current payments that would be reflecting on your credit report plus your proposed housing expenses can be over 56% of your gross income. For self employed borrowers we have to go off of your net income or what you paid taxes on, but we can include depreciation and a portion of your mileage deductions and well as a portion of your meals and entertainment expense back in as useable income.

What about closing costs with FHA loans?

Currently the FHA charges 1.75% of the loan amount, called a guarantee fee. This fee however can be financed into the loan. Other closing costs will be similar to any other financing options. Points can be paid to reduce the interest rate. Terms are available from 15, 20, and 30 year mortgages, arms are also possible. However one advantage of FHA financing versus conventional financing is that with FHA financing you are allowed to ask for seller concession for closing costs up to 6% of the sales price. With conventional financing for first time home buyer’s at 3% down the max the seller can contribute for closing costs is 3%.

FHA mortgage financing in summary.

FHA mortgage financing is a great way to make your home ownership dreams possible! Lots of first time home buyers utilize the program but even people buying their second or third home can find use for the program. They make refinancing super easy with a FHA streamline refinance as well, no appraisal required and no income verification. If you’re tight on funds and you need the low down payment and the seller concessions for closing costs its hard to beat.

The mortgage insurance at .55% is a competitive mortgage insurance rate. You will also find your interest rate will be very competitive compared to conventional financing. You can use the program to purchase a single family home, manufactured home, townhome, and in some cases a condo. It must be your primary residence though. Reach out to us today with any questions, we would be glad to help. Or if you’re ready to take the next step begin the app for a mortgage pre-approval below!

Get Pre-approved

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

Black Rock Mortgage

a division of Coast 2 Coast Mortgage

Company NMLS: 376205

CA 60DBO-139024

93 ½ King Street

St. Augustine, FL 32084

Contact

Toll Free: (855) 482-6466

Local: (352) 619-4959

keith@blackrockmortgage.com

Fax: (888)-979-6574

Quick Links

Fax: (888)-979-6574

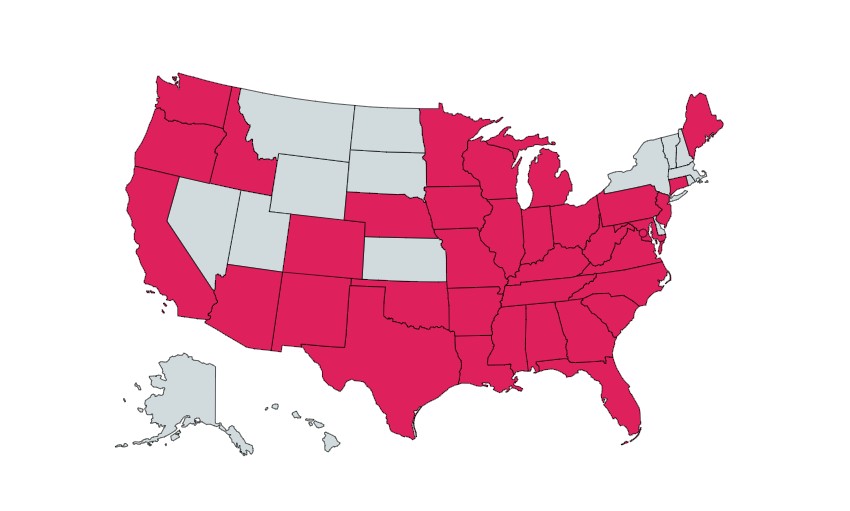

News & Updates

This website and the content within is not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. We are licensed in Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Colombia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virgin Islands, Virginia, Washington, West Virginia, Wisconsin.