Conventional Mortgage Financing

Conventional mortgages empower you with the leverage to meet your financial goals.

Conventional mortgage financing defined.

A conventional conforming mortgage is either backed by Fannie Mae or Freddie Mac. These programs are known for being utilized by borrowers with better than average credit. They come with the least cost, and mortgage insurance rates based on credit worthiness. They also provide more flexibility for self employed borrowers than other government backed programs like FHA, VA, or USDA financing. Oftentimes allowing for the utilization of one year of tax returns for self employed borrowers instead of two.

Why conventional?

Whether or not your loan is backed by Fannie or Freddie comes down to some very nuanced differences between the two governments sponsored entities. Why do banks lend according to Fannie or Freddie guidelines? Because by meeting or conforming to their guidelines is creates a guaranteed marketplace to sell loans. This liquidity is what keeps the banking industry sound. When banks need to sell loans they don’t have to make a case for each loan, they can bundle them together and sell them on the open market knowing they meet the standards.

What are my options with conventional mortgage financing?

You can buy with as little as 5% down with conventional financing, If you are a first time home buyer you can buy with as little as 3% down. The minimum credit score is going to be 620. If your score is that low though in most cases it will be more advantageous to use alternative financing options like FHA. 30 year terms are common, but a 15, 20 year, or even a flex term is possible where you name the amount of years you want to finance your mortgage.

What can I buy with conventional financing?

Conventional financing can be utilized to purchase single family homes, townhomes, quadraplexes, second homes, investment homes, condo’s and manufactured homes. With a 20% down payment you can avoid any mortgage insurance. Mortgage insurance also known as PMI (private mortgage insurance) is required in the case of default. Unlike mortgage insurance on government backed loans, pmi on conventional mortgages is based on both the loan to value and the credit score of the borrower. So people high credit scores can have very low pmi rates compared to those with lower scores.

What’s the story with appraisals?

Another positive of utilizing conventional financing is the possibility of an appraisal waiver. With a high enough credit score, and or a low enough loan to value ratio on the loan versus the value of the property, you could get an appraisal waiver. That’s exactly what it sounds like, on occasion Fannie or Freddie gives borrowers the ability to finance a property without the need for an appraisal. This is one of the reason its always prudent to run the automated underwriting system for both Fannie and Freddie to see if either is providing the appraisal waiver. We are always looking for ways to save clients money.

Conventional mortgage financing in summary.

Conventional financing options are not a one size fits all, and understanding the difference between what you can do with Fannie that you can’t with Freddie and vice versa is key to meeting the goals of our mortgage clients. We pride ourselves on working with the best lenders in the nation on both loan products and rate. For instance we have the ability to waive escrows with conventional financing even with a 5% down payment. Most lenders require a 20% down payment to pay taxes and insurance separate from their monthly payment. Reach out to us today with any questions, we would be glad to lend our expertise.

Get Pre-approved

“We are dedicated to meeting your financing needs. Please feel free to apply for a mortgage pre-approval or to reach out to us directly so we can answer any questions you may have. Thank you and we look forward to serving you.” -Keith Meredith, Division President

Black Rock Mortgage

a division of Coast 2 Coast Mortgage

Company NMLS: 376205

CA 60DBO-139024

125 B King Street

St. Augustine, FL 32084

Contact

Toll Free: (855) 482-6466

Local: (352) 619-4959

keith@blackrockmortgage.com

Fax: (888)-979-6574

Quick Links

Fax: (888)-979-6574

News & Updates

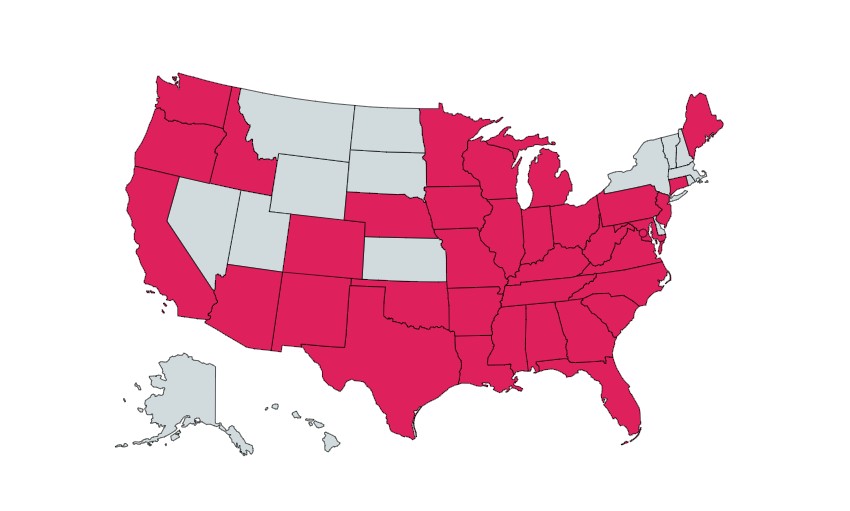

This website and the content within is not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. We are licensed in Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Colombia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virgin Islands, Virginia, Washington, West Virginia, Wisconsin.